Gmail Rajesh Sharma <smtrajeshsharma11@gmail.com>

CGRMS Alert PC1611202311040301

1 message

cgrms@pnb.co.in <cgrms@pnb.co.in> 16 November 2023 at 11:16

Reply-To: cgrmshelp@pnb.co.in

To: smtrajeshsharma11@gmail.com

Dear Customer,

This is to inform that we have received your complaint PC1611202311040301 about ADEQUACY OF STAFF AT BRANCH COUNTERS.

We are investigating the factors causing the problem and our team is making efforts to resolve within 15 working days.

Thank you for letting us know your concern, and for your patience while we explore this matter.

Yours Sincerely

Centralized Grievance Redressal & Management System

Punjab National Bank

HO: Customer Care Centre

Operations & Government Business Division

New Delhi

Grievance Status for registration number : DEABD/E/2023/0069585

Grievance Concerns To

Name Of Complainant

Smt Rajesh Sharma

Date of Receipt

07/10/2023

Received By Ministry/Department

Financial Services (Banking Division)

Grievance Description

Financial Services (Banking Division) >> Deficiency in Customer Service Related >> Others

Bank : Punjab National Bank

Branch / Name of Bank and Branch : PNB Civil lines, Bulandshahr, Branch Manager - Akhilesh

Account Number : 0069008700013264

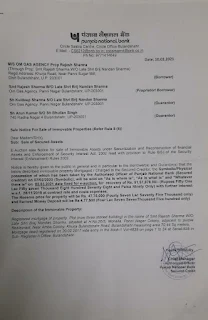

Chief manager and branch manager of Punjab National Bank should honour direction of division bench of the High court of judicature in letter and spirit to provide justice.

Respected staff of Punjab National Bank, in the following writ petition WRIT - C No. - 29195 of 2023, division bench of the high court of judicature at Allahabad directed the parties as follows-

Supplementary affidavit filed today will be kept on record.

Put up this case on 18.10.2023 as fresh.

In the meantime, parties to avail the opportunity to settle the loan

in the negotiations which are going on between the petitioners and

the Bank.

Order Date :- 4.10.2023

For more details, please take the perusal of the first page of the attached PDF document.

The current status of the case is as-Bank loan on the applicant is Rs.4296538.07 while the loan limit is Rs.50 Lakhs. The process of the renewal was deliberately cancelled by misinterpreting and manipulating the made available stock data by the gas agency through cryptic and mysterious dealings by the branch manager of Punjab National Bank.

If the staff of the bank verified the stock in the year 2017 during the sanction of the loan and in the year 2022 during the renewal of the loan found the same, how can Punjab National Bank may cancel the renewal application in the name of insufficient stock?

It must be noted that the applicant from 27-10-2021 to 02-08-2023, has Deposited 3067312.83 Lakhs In PNB CC account - 0069008700013264. Punjab National Bank did not renew C.C. Loan by arbitrarily saying agency submitted stock Rs.704890 however Om Gas Agency has stock Rs.7025416.00 which is supported by report of C.A. and staff of B.P.C.L.

Please renew C.C. loan account of applicant through proper verification of stock in transparent and accountable manner. You have power to lower the limit but cancellation will put the applicant and her family on the road. Please resolve the issue before .18.10.2023 so that an amicable solution may be brought up before court.

Grievance Document

Current Status

Case closed

Date of Action

03/11/2023

Remarks

the reply is attached

Reply Document

Rating

1

Poor

Rating Remarks

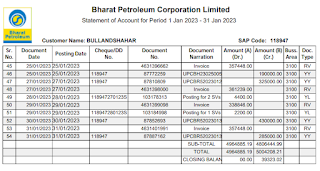

The matter concerns the illegal cancellation of the renewal of the cash credit account in the name of insufficient stock of the applicant by submitting false and fabricated report by the staff of the Punjab National Bank so the need of hour is to take action against the wrongdoer staff of the Punjab National Bank and direct them to consider the submissions of the applicant and adopt a logistic approach in the matter to reach on a logical conclusion of renewing the C.C. Account. Most respected chief manager, it is quite obvious from the account of Om Gas Agency in Bharat Petroleum Corporation limited a government of India enterprise-Total Dr. in the month of January 2023 is Rs.4964885.19 and Total Cr. in the month of January 2023 is Rs.5004208.21 It is quite obvious from the account of Om Gas Agency in Bharat Petroleum Corporation limited a government of India enterprise-Total Dr. in the month of February 2023 is Rs.5322362.64 and Total Cr. in the month of February 2023 is Rs.5194413.74 It is quite obvious from the account of Om Gas Agency in Bharat Petroleum Corporation limited a government of India enterprise-Total Dr. in the month of March 2023 is Rs.5285849.33 and Total Cr. in the month of March 2023 is Rs.5339669.27

Appeal Details

Appeal Number

DEABD/E/A/23/0022704

Date of Receipt

16/11/2023

Appeal Text

1-According to the aforementioned communication-As per bank norms, the Drawing power is ascertained on the value of the stock every month. 2-In the month of December 2022 the amount paid to Bharat Petroleum Corporation Limited a government of India enterprise for the Om Gas Agency is Rs.4394000.00. 3-Here it is quite obvious that whatever stock has been shown in their reports submitted by the staff of the Punjab National Bank is concerned with the payment of two consignments of the Bharat Petroleum Corporation limited. 4-It must be noted that in one month from 15 to 18 such consignments are sent by the Bharat Petroleum Corporation limited a government of India enterprise which is quite obvious from the payments made by the applicant from the current account opened in the Punjab National Bank. 5-It is most unfortunate that you are falsely claiming that the applicant submitted the stock statement on 30.06.2022 is of Rs. 6,51,030 and on 31.08.2022 is of Rs. 7,04,890 only in the branch. It is quite obvious from the account of Om Gas Agency in Bharat Petroleum Corporation limited a government of India enterprise-Total Dr. in the month of August 2022 is Rs.3581522.14 and Total Cr. in the month of August 2022 is Rs.3557089.24 It is quite obvious from the account of Om Gas Agency in Bharat Petroleum Corporation limited a government of India enterprise-Total Dr. in the month of June 2022 is Rs.3161151.11 It is quite obvious from the account of Om Gas Agency in Bharat Petroleum Corporation limited a government of India enterprise-Total Dr. in the month of August 2022 is Rs.3581522.14 and Total Cr. in the month of August 2022 is Rs.3557089.24 It is quite obvious from the account of Om Gas Agency in Bharat Petroleum Corporation limited a government of India enterprise-Total Dr. in the month of June 2022 is Rs.3161151.11 and Total Cr. in the month of June 2022 is Rs.2982337.72

Current Status

Appeal Received

Officer Concerns To

Officer Name

Shri Pulin Kumar Pattanaik (General Manager)

Organisation name

Punjab National Bank

Contact Address

Corporate Office Plot No 5, Sector -32, Gurugram, Haryana

Email Address

pno@pnb.co.in

Contact Number

01244126244

Grievance Status for registration number : DEABD/E/2023/0070498

Grievance Concerns To

Name Of Complainant

Smt Rajesh Sharma

Date of Receipt

12/10/2023

Received By Ministry/Department

Financial Services (Banking Division)

Grievance Description

Financial Services (Banking Division) >> Misbehaviour/Harrassment/Corruption by Bank Staff

Bank/Financial Institute : Punjab National Bank

Branch / Name of Bank and Branch : Chief Manager Circle office Bulandshahr, Uttar Pradesh

-----------------------

Reverification of stock of Om Gas Agency by Punjab National Bank in transparent and accountable manner only already done is wrong.

The matter concerns the denial to take the representation in compliance of order passed by high court of judicature at Allahabad quite obvious from the attached PDF documents of the applicant.

Respected staff of Punjab National Bank, in following writ petition WRIT - C No. - 29195 of 2023, division bench of the high court of judicature at Allahabad directed the parties as follows-

Supplementary affidavit filed today will be kept on record.

Put up this case on 18.10.2023 as fresh.

In the meantime, parties to avail the opportunity to settle the loan

in the negotiations which are going on between the petitioners and

the Bank..

Order Date :- 4.10.2023

The applicant has submitted the following online grievance cum representation before the Punjab National Bank in the compliance of the order of the most respected High Court of judicature at Allahabad which was issued by it as above, on 7th October 2023 as follows.

Grievance Status for registration number : DEABD/E/2023/0069585

Grievance Concerns To Name Of Complainant-Smt Rajesh Sharma, Date of Receipt-07/10/2023

It is most unfortunate neither branch office of the Punjab National Bank civil lines Bulandshahr took the hard copy in the sign of the applicant as well as circle office of the Punjab National Bank at Bulandshahr took the Representation of the applicant moreover suggested to send the representation through the registered post.

Whether it is not reflecting arbitrariness and tyranny of the staff of the Punjab National Bank who are overlooking the applicant deliberately and harassing her?

Think about the pride of them having no regard to the advice of the highest judiciary in the state and only promoting the cryptic and mysterious dealings which were done by them earlier. The applicant requests to you Honourable sir to take the perusal of the attached PDF document to this grievance.

Grievance Document

Current Status

Case closed

Date of Action

03/11/2023

Remarks

the reply is attached

Reply Document

Rating

1

Poor

Rating Remarks

The matter concerns the illegal cancellation of the renewal of the cash credit account in the name of insufficient stock of the applicant by submitting false and fabricated report by the staff of the Punjab National Bank so the need of hour is to take action against the wrongdoer staff of the Punjab National Bank and direct them to consider the submissions of the applicant and adopt a logistic approach in the matter to reach on a logical conclusion of renewing the C.C. Account. Most respected chief manager, it is quite obvious from the account of Om Gas Agency in Bharat Petroleum Corporation limited a government of India enterprise-Total Dr. in the month of January 2023 is Rs.4964885.19 and Total Cr. in the month of January 2023 is Rs.5004208.21 It is quite obvious from the account of Om Gas Agency in Bharat Petroleum Corporation limited a government of India enterprise-Total Dr. in the month of February 2023 is Rs.5322362.64 and Total Cr. in the month of February 2023 is Rs.5194413.74 It is quite obvious from the account of Om Gas Agency in Bharat Petroleum Corporation limited a government of India enterprise-Total Dr. in the month of March 2023 is Rs.5285849.33 and Total Cr. in the month of March 2023 is Rs.5339669.27

Appeal Details

Appeal Number

DEABD/E/A/23/0022705

Date of Receipt

16/11/2023

Appeal Text

1-According to the aforementioned communication-As per bank norms, the Drawing power is ascertained on the value of the stock every month. 2-In the month of December 2022 the amount paid to Bharat Petroleum Corporation Limited a government of India enterprise for the Om Gas Agency is Rs.4394000.00. 3-Here it is quite obvious that whatever stock has been shown in their reports submitted by the staff of the Punjab National Bank is concerned with the payment of two consignments of the Bharat Petroleum Corporation limited. 4-It must be noted that in one month from 15 to 18 such consignments are sent by the Bharat Petroleum Corporation limited a government of India enterprise which is quite obvious from the payments made by the applicant from the current account opened in the Punjab National Bank. 5-It is most unfortunate that you are falsely claiming that the applicant submitted the stock statement on 30.06.2022 is of Rs. 6,51,030 and on 31.08.2022 is of Rs. 7,04,890 only in the branch. It is quite obvious from the account of Om Gas Agency in Bharat Petroleum Corporation limited a government of India enterprise-Total Dr. in the month of August 2022 is Rs.3581522.14 and Total Cr. in the month of August 2022 is Rs.3557089.24 It is quite obvious from the account of Om Gas Agency in Bharat Petroleum Corporation limited a government of India enterprise-Total Dr. in the month of June 2022 is Rs.3161151.11 It is quite obvious from the account of Om Gas Agency in Bharat Petroleum Corporation limited a government of India enterprise-Total Dr. in the month of August 2022 is Rs.3581522.14 and Total Cr. in the month of August 2022 is Rs.3557089.24 It is quite obvious from the account of Om Gas Agency in Bharat Petroleum Corporation limited a government of India enterprise-Total Dr. in the month of June 2022 is Rs.3161151.11 and Total Cr. in the month of June 2022 is Rs.2982337.72

Current Status

Appeal Received

Officer Concerns To

Officer Name

Shri Pulin Kumar Pattanaik (General Manager)

Organisation name

Punjab National Bank

Contact Address

Corporate Office Plot No 5, Sector -32, Gurugram, Haryana

Email Address

pno@pnb.co.in

Contact Number

01244126244