Grievance Status for registration number : PMOPG/E/2023/0080574

Grievance Concerns To

Name Of Complainant

Yogi M. P. Singh

Date of Receipt

14/04/2023

Received By Ministry/Department

Prime Ministers Office

Grievance Description

Central Board of Direct Taxes (Income Tax) >> Corruption/Malpractices related (VCs, employees) >> Inaction by Income Tax Department

Name and Desination of Officer : Manish Mishra, CIT e-Verification

regional office / Office : DGIT(Systems) CPC, E-filing

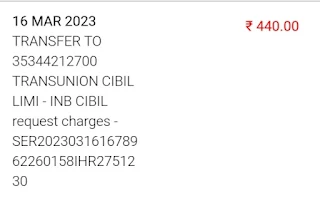

16 MAR 2023 440.00 TRANSFER TO 35344212700 TRANSUNION CIBIL LIMI - INB CIBIL request charges -SER2023031616789 62260158IHR27512 30 Respected sir the screenshot of the aforementioned transaction is attached to the grievance in PDF form. One month passed, unfortunately State Bank of India did not provide the applicant CIBIL report. The root cause of not providing the CIBIL report is the anonymous transactions made by cheaters by misusing my Aadhar Card and PAN card by colluding with the staff of the income tax and State Bank of India. CIBIL score and CIBIL report is automatically made available by NSDL but after payment of Rs.440 through SBI internet banking, CIBIL report was not made available.

CIBIL Report is an automatic process coordinated by the department of income tax and state bank of India unfortunately not providing after payment is showing mysterious dealings of aforementioned public authorities.

The reply of the state bank of India is as follows. We have to state that we have escalated your issue to our IT /INB support team CBD Belapur Mumbai for needful action at their end सादर / Regards Assistant General Manager State Bank Of India

Sir, there is no cibil score and cibil report but there is little change in the status that it is showing successful. Which means State Bank of India is saying that I have payment of Rs. 440 for cibil report but still there is no cibil report.

The matter concerns deep-rooted corruption in the working of state bank of India and department of income tax. How can they overlook the matter in such a negligent way. Grievance Status for registration number : DEABD/E/2023/0026488

Grievance Concerns To Name Of Complainant-Yogi M. P. Singh, Date of Receipt 16/03/2023, Received By Ministry/Department-Financial Services (Banking Division)Please provide CIBIL report to the applicant. I have applied for a CIBIL report through the internet banking of the State Bank of India. It is unfortunate you did not provide the CIBIL report concerning

Grievance Document

Current Status

Under process

Date of Action

14/04/2023

Officer Concerns To

Officer Name

Sh. Y. K. Singh (DGIT)

Organisation name

DIRECTOR GENERAL OF INCOME TAX (SYSTEM)

Contact Address

ARA centre GROUND FLOOR, E-2, JHANDEWALAN EXTEN NEW DELHI-110 055

Email Address

dgit.systems@incometaxindia.gov.in

Contact Number

01120920385

Reminder(s) / Clarification(s)

Reminder Date

Remarks

14/04/2023

An application under Article 51 A of the constitution of India to make enquiry regarding deep-rooted corruption in the working of department of income tax of India by colluding with corrupt staff of the department of income tax of India. Grievance Status for registration number : CBODT/E/2023/0007645

Grievance Concerns To Name Of Complainant-Yogi M. P. Singh, Date of Receipt-07/02/2023, Received By Ministry/Department-Central Board of Direct Taxes (Income Tax)

Following information does not belong to the applicant Mobile Number-7024188072, E-mail Address- dngoldraipur18@gmail.comUndoubtedly, You know my email and mobile number on which you stream messages regarding high value transactions and income tax return. Everyone knows that my family is on the verge of hunger and I have no relation with these high value transactions and such cunning tricks are adopted by the corrupt staff of the department of income tax by colluding with unethical businessmen with the blessings of the senior rank bureaucrats and political masters in the country. MAHESH PRATAP SINGH XXXXX0850X

DIN: INSIGHT/CMP/01/2022-23/10230022276330001Date: 13-03-2023Assessment Year: 2023-24Financial Year: 2022-23FacelessAssessmentFacelessIncomeTaxWhy are you receiving this communication?

Dear Taxpayer, The Income Tax Department has received information on financial transactions/activities relating to MAHESH PRATAP SINGH PAN XXX0850X for Financial Year 2022-23 Assessment Year 2023-24.The details of the transactions may be viewed as under: Business receipts - Rs 1,49,04,041GST purchases - Rs 5,99,33,331GST turnover - Rs 8,63,69,295

Action must be taken against Manish Mishra, CIT e-Verification Aayakar Bhawan, Vaishali, Sector-3, Ghaziabad, Uttar Pradesh, Mobile number-7599103315 for sending irritating messages without proper verification on the email and mobile number of the applicant. Transactions of Rs 16,12,06,667 concerning my PAN is showing failure and corruption of department of income tax

To see Payment and status of CIBIL report, click on it